These investment gurus taught us lessons like Patience, discipline, and rationality.

On this Teachers’ Day, let’s reflect on some key elements of the investment philosophies of five all-time great investors.

Warren Buffett

Not many can match the popularity and charisma that Buffett has in the world of investing. He simply makes investing look easy.

Identifying successful and strong companies with reasonably priced stocks has been one of the central ideas of Buffett’s investing philosophy.

A company’s competitive advantage and its potential to generate profit in the long term are the key elements of Buffett’s investing style. He has often said it publicly that an investor must buy a stock that he/she can hold for 10 years, irrespective of short-term developments.

One of the core principles of Buffett’s investing philosophy is buying when others are selling. “Be fearful when others are greedy and be greedy when others are fearful,” he has been quoted saying on several occasions. This attitude shows your discipline and rationality also when you pick up a stock that is down but has the potential to withstand the turmoil.

Warren Buffett is famous for investing in businesses he is confident about. He never lets his emotions take the driving seat but makes a rational decisions with a deep understanding of all aspects of the business. He has often said, “Never lose your money. Stay rational and control your emotions. Never invest in a business that you don’t understand.”

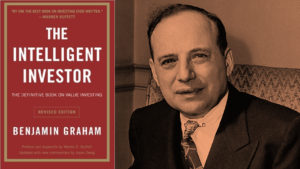

Benjamin Graham

Popularly known as the father of value investing, Graham was an American investor and economist who wrote a widely acclaimed book “The Intelligent Investor” on value investing.

The book has been described as “the best book about investing ever written” by Warren Buffett.

Graham’s investment style focused on discipline and rationality. “Investing isn’t about beating others at their game. It’s about controlling yourself at your own game.”

Graham believed in facts and analysis rather than intuition. As in his opinion “a stock investor is no right or wrong because others agreed or disagreed with him. He is right because his facts and analysis are right”.

Graham also believed in the thumb rule of investing – buying cheap, selling dear, and keeping it for a long time.

One of the cornerstones of his investing philosophy was to have faith in the company’s values. Not focusing too much on the volatility in stocks. “Invest only if you are comfortable owning a stock. Even if you had no way of knowing its daily share price.”

His idea was, that one must thoroughly analyze a company and the soundness of its underlying businesses, before buying its stock.

Philip Arthur Fisher

An American stock investor, Philip Fisher’s investment philosophy was based on the simple idea of investing in those companies which have the potential to grow.

He focused on a long-term horizon and awareness about the business he invested in was his prime focus.

Fisher believed the ability of a company to meet the changing needs and desires of its customers makes the company worth investing in.

Patience and avoiding the herd mentality were the important points of Fisher’s style of investing. He has often been quoted as saying that doing what everybody else is doing now is often the wrong thing to do and patience is essential if big profits are to be made from an investment.

Jack Bogle

John Clifton ‘Jack’ Bogle was the founder of The Vanguard Group who popularised low-cost index investing among millions of people.

Long-term investing and diversity were the focal points of his investment style. Unlike the trend, he did not believe in individual stock-picking and favored diversified index fund portfolios.

One of his famous quotes is, “Don’t look for the needle in the haystack. Just buy the haystack!”

Bogle did not believe in timing the market and found it a less credible idea as his quote suggests, “The idea that a bell rings to signal when investors should get into or out of the market is simply not credible. After nearly 50 years in this business, I do not know of anybody who has done it successfully and consistently.”

Patience, discipline, and rationality have been the central ideas of most all-time great investors. These ideas are relevant not only for investment but for living a fulfilling life as well.

Peter Lynch

A legendary investor Peter Lynch is one of the most successful and well-known investors of all time. His investment philosophy, too, had discipline as the key theme. “The trick is not to learn to trust your gut feelings, but rather to discipline yourself to ignore them.”

Lynch believed in learning lessons and taking things in stride. One of the important lessons one can learn from Lynch is that success comes after many setbacks, and one should take them as lessons. “People who succeed in the stock market also accept periodic losses, setbacks, and unexpected occurrences.”

Knowing what you own and knowing why you own it was also a key point in Lynch’s investing style. This is like Buffett’s and Graham’s belief in understanding the businesses and the functioning style of a company before investing in it.

Disclaimer: The quotes used in the article have been taken from the public domain and investoinsure.com does not claim their exclusivity. investoinsure.com advises users to check with certified experts before taking any investment decisions. The content of this article is from a money control article.

Be a wise investor – Connect