What is PPF?

Public Provident Fund (PPF) scheme is a popular long-term investment option backed by the Government of India which offers safety with returns that are fully exempted from Tax. Investors can invest a minimum of Rs. 500 to a maximum of Rs. 1,50,000 in one financial year and can get the facilities such as loan, withdrawal, and extension of account. Also, the total lock-in for the PPF account is 15 years which is too high compared to other instruments available like Mutual fund ELSS, NSC, etc.

Features of PPF account

- The interest rate of 8% per annum.

- Minimum and maximum investment Rs.500 & 1.5L per annum.

- The Lock-in period is 15 Years.

- Partial withdrawal is available after 7 years.

- After 15 years account can be extended for a block of 5 years.

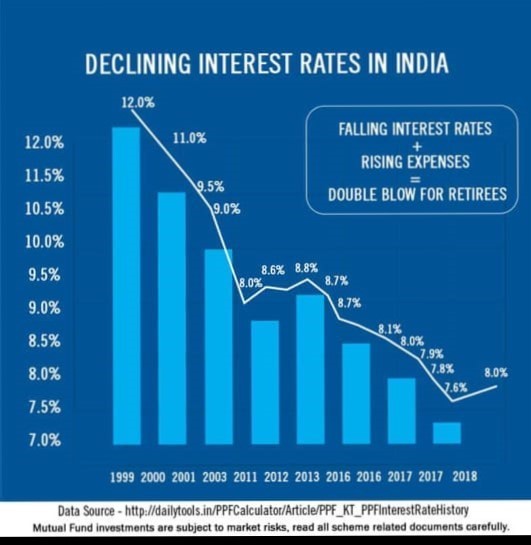

PPF has become less attractive over a period since it started declining interest rates, have a look

- Rates were fixed at 12% between 1986 and 2000

- Then between 2000 and 2003, the rates slid down to 8%

- The rates then remained stable at 8% till 2011

- Rates were then revised to 8.6%, 8.8%, and 8.7%.

- The last few years saw rates come down to 8.1%, 8.0%, 7.9%, 7.8%, and then a historic low of 7.6%.

- Rates finally saw an uptick of 8.0%.

With effect from 1st April 2016, the rates for schemes like PPF, etc. are to be considered for revision every quarter, based on the previous quarter’s yield on benchmark government securities (or bonds of corresponding maturities) with a small markup (around 0.25%).

What’s the risk?

Earlier, rates were revised once every year. But now, the revision will take place every quarter.

So, there is obviously an increase in interest rate risk as far as PPF is concerned. So, in a falling rate scenario and for someone who has a large PPF balance, it can hurt a lot.

Also, Lock-in for PPF is 15 years and in 15 years we have 60 quarters for rate fluctuation which is high.

Now, what to do?

You can check for various alternatives like NSC, ELSS (mutual funds), Tax saving bonds, etc. But among tax-saving instruments, the clear winner as of now is ELSS (Mutual fund) but a subsequent risk is also involved with it.

The risk-reward ratio works with mutual funds the higher the risk you take the more returns you get. Also, the ELSS Mutual fund has the lowest lock-in period of just 3 years. The average return in ELSS Schemes for the last 5 years is 12-16% per annum which is much higher than PPF, NSC Fixed deposits, etc.

Now let’s choose the best option with comparison.

ELSS VS PPF VS FIXED DEPOSITS

| Particulars | ELSS (Mutual funds) | PPF | Fixed deposits |

| Objective | Growth with Income tax rebate under sec 80C | Limited growth with Income tax rebate under sec 80C | Limited growth with Income tax rebate under sec 80C |

| Lock-In period | 3 years | 15 years | 5 years |

| Average Return | 12-16%* | 7-9% | 7-8% |

| Risk | Moderate to High | Low | Moderate |

| Maturity | After 3 years but can be kept for appreciation to n number of years | After 15 years but can be extended in block of 5 years. | After 5 years and cannot be extended |

| Tax | 10% LTCG on returns if gains are higher than1 lac | No tax | Taxable as per Income tax slab. |

| Post-tax Return | 10.8 – 14.4%** | 7-9% | 5.6 – 6.4%*** |

*Returns are subject to market conditions; returns are indicated as per past performance and can be changed in the future.

** After deducting 10% LTCG from average returns.

*** After deducting tax rated as 20% tax bracket.

Conclusion

PPF is no more an attractive option for tax savings rather If you can take moderate to high risk then you can opt for ELSS Mutual funds.

Each investment is associated with certain positive and negative Parameters (mentioned in the above table).

For more information connect with us – Here!